Thought of the Day

“If [a person] were able to survey at a glance all he has done in the course of his life, what would he feel? He would be terrified at the extent of his own power.” -Rabbi Abraham Joshua Heschel

“If [a person] were able to survey at a glance all he has done in the course of his life, what would he feel? He would be terrified at the extent of his own power.” -Rabbi Abraham Joshua Heschel

By STEVE REED AP Sports Writer

CHARLOTTE, N.C. (AP) — Carolina Panthers running back Rico Dowdle had a message for his former team after rushing for a career-best 206 yards last Sunday against the Miami Dolphins.

“Better buckle up,” Dowdle warned the Dallas Cowboys, who have the 32nd-ranked defense.

Dowdle didn’t back down from that message this week, adding: “It’s going to be a very physical game. I take pride in that. Buckle your chinstraps up. I will be coming.″

The Cowboys insist they’ll be ready.

“He gotta back it up,” Cowboys defensive tackle Kenny Clark said. “I’m not much into talking. He ain’t played nobody like us and we ain’t played them.”

Dowdle should be plenty motivated.

He spent five seasons with the Cowboys (2-2-1) and eclipsed 1,000 yards rushing last year, but team owner/general manager Jerry Jones opted not to re-sign Dowdle and go in a different direction. Dowdle found limited options in the free agent market and wound up taking a backup role behind Chuba Hubbard in Carolina.

With Hubbard out last week with a calf injury, Dowdle got his first start for Carolina and turned in the third-best rushing performance in franchise history as the Panthers (2-3) battled back from 17 points down to beat Miami 27-24. He had two runs of longer than 50 yards and also scored.

Hubbard will miss a second straight game after being ruled out for the game on Friday.

Hubbard, who ran for nearly 1,200 last yards and 10 TDs last season, didn’t practice all week. Coach Dave Canales said earlier in the week he knows Hubbard is “chomping at the bit” to get back, but wants to make sure he isn’t rushing back too soon.

Canales said even if Hubbard did return, Dowdle would still play.

“It’s a great feeling for me,” Canales said. “I look down on the call sheet — I don’t have to worry about who’s in there. To know we’ve got two solid backs that we love, it just allows us to continue to play our brand of football and get a fresh set of legs in there that can execute.

“We’ll figure out how to use both guys when that time comes.″

The Cowboys also are coming off a productive day on the ground.

Dallas rushed for a season-high 180 yards in a dominant 37-22 win over the New York Jets despite missing four starting offensive linemen. Both left-side starters could be back in tackle Tyler Guyton (concussion) and guard Tyler Smith (knee). Rookie right guard Tyler Booker has also been out. Center Cooper Beebe (foot) will miss his fourth game on injured reserve against the Panthers, then be eligible to return.

“I still can’t think of one where I’ve ever gone in before, the different starting offensive linemen,” coach Brian Schottenheimer said. “We have to come up with plans that we think feature what they do well along with attacking your opponent. But at the end of the day, the players are the magic.”

George Pickens has played two games without new sidekick – and incumbent No. 1 Dallas receiver – CeeDee Lamb, who’s nursing a high ankle sprain. It appears Lamb will be sidelined again, although he’s getting closer to a return.

The first game without Lamb, Pickens had one of the two best games of his career with eight catches for 134 yards and two touchdowns in a 40-40 tie with Green Bay. In last week’s 37-22 victory over the New York Jets, Pickens had a 43-yard TD grab for a 30-3 lead.

Pickens came to Dallas in an offseason trade from Pittsburgh, where Pickens was prone to emotional outbursts and penalties that once prompted coach Mike Tomlin to say the 24-year-old needed to grow up. The future has brightened considerably for a 2022 second-round pick in the final year of his rookie contract.

“I feel like I was always having fun,” Pickens said. “I just feel like the narrative never showed me having fun. I feel like right now it’s a good thing for the team.”

The Panthers had just two sacks through the first four games, which rookie Princely Umanmielen and others called embarrassing.

The result was a players-only defensive team meeting before last week’s game — one that seemed to work.

Carolina had three sacks in the win over the Dolphins with A’Shawn Robinson, Derrick Brown and Patrick Jones II all getting to Tua Tagovailoa.

The Panthers are hoping to build on that success this week, but it won’t be easy. Dak Prescott has been one of the better protected QBs in the league. He has been sacked seven times through five games and his 3.4% sack rate on drop-backs is the fifth-lowest mark in the league.

After being held to 8 yards on four catches in his first four games and missing the next two due to a hamstring injury, Panthers wide receiver Xavier Legette was lacking some confidence. The Panthers hope that has changed after Legette caught a key touchdown pass from Bryce Young last week that helped spark a comeback from a 17-point deficit against Miami.

“You hope those opportunities come up where the coverage points to a 1-on-1 chance for a guy to make a play,” Panthers offensive coordinator Brad Idzik said. “I think the throw from Bryce, having to get that ball out, knowing at the time of the release of the throw, the leverage might not have been what he wanted, but he knew Xavier was going to make that play.

“And then Xavier, to go track that thing, a low ball, that was a really remarkable catch.”

The Panthers are 2-0 at home and Canales is excited to be at Bank of America Stadium for the first time in back-to-back games this year.

“I mean, speaking personally, it’s just spending time with my family, spending time with my wife and my kids throughout the week,” Canales said. “And where you normally get on a plane sometime on Saturday afternoon, and I get to go see soccer and, you know, those types of things that just put you in a good state of mind.”

___

AP Sports Writer Schuyler Dixon is Dallas contributed to this report.

By LISA MASCARO AP Congressional Correspondent

WASHINGTON (AP) — Mike Johnson is the speaker of a House that is no longer in session.

The Republican leader sent lawmakers home three weeks ago after the House approved a bill to fund the federal government. And they haven’t been back in working session since.

In the intervening weeks, the government has shut down. President Donald Trump threatened a mass firing of federal workers. And a Democrat, Adelita Grijalva, won a special election in Arizona but has not been sworn into office to take her seat in Congress.

“People are upset. I’m upset. I’m a very patient man, but I am angry right now,” Johnson said during one of his almost daily press conferences on the empty side of the Capitol.

“The House did its job,” said Johnson, of Louisiana. There’s nothing left to negotiate, he says, arguing it’s up to the Senate, which is also controlled by Republicans, to act. “That ball has been sent to the other court.”

The House’s absence is creating a risky political dilemma for Johnson. It’s testing his leadership, his grip on the gavel and the legacy he will leave as speaker of a House that is essentially writing itself off the page at a crucial moment in the national debate.

There are few easy choices on the schedule ahead. If the speaker calls lawmakers back to Washington, he opens the doors to a potentially chaotic atmosphere of anger, uncertainty and his own GOP defections and divisions as the shutdown drags toward a third week.

But by keeping the representatives away, lawmakers risk being criticized for being absent during a crisis — “on vacation,” as House Democratic Leader Hakeem Jeffries puts it — as the military goes without pay and government services shut down.

Johnson’s initial strategy to avoid the government shutdown was a well-worn one — have the House pass its bill, leave town right before the deadline and force the Senate to accept it. Jamming the other chamber, as it’s often called. And it often works.

But this time, it’s a strategy that is failing.

GOP senators have been unable to heave the House bill to passage, blocked by most of the Democrats, who are refusing to reopen the government as they demand health care funds for insurance subsidies that will expire at year’s end if Congress fails to act.

Senate Majority Leader John Thune, R-S.D., has been trying, repeatedly, to peel off more Democratic support.

But after having called a vote more than a half-dozen times to pass the House’s bill out of the Senate, not enough Democrats have signed on as they hold out for a deal on the health care issue.

Stalemated, quiet talks are underway, as small groups of lawmakers are privately trying to negotiate off-ramps.

Republican Sen. Lisa Murkowski of Alaska has proposed keeping the health care subsidies in place for the next two years while instituting changes to the program. Sen. Mike Rounds, R-S.D., has a similar proposal, and GOP Sen. Susan Collins of Maine has shared with leadership her own six-point plan.

“We’re making progress,” said Sen. Markwayne Mullin, R-Okla., who is close to the Republican president. “I think we’re kind of starting to get to a place.”

Not since then-Speaker Nancy Pelosi, a Democrat, sent lawmakers home at the start of the coronavirus pandemic in 2020 has the House been without its lawmakers for such an extended period of time outside of an August recess — but even then, leaders quickly stood up a new system of proxy voting as legislative business continued.

In the Capitol’s empty halls, a few lawmakers linger. They have been filming social media posts as they narrate the inaction. They have created viral moments, including GOP Rep. Mike Lawler’s confrontation with Jeffries. Some are simply giving tours to visiting constituents.

GOP Rep. Marjorie Taylor Greene of Georgia has been among the most outspoken critic of her party’s stance, saying Congress needs to address the subsidies.

And Grijalva is just trying to go to work.

The representative-elect won the special election to replace her father, veteran Rep. Raul Grijalva, who died earlier this year after his own career in Congress.

Her arrival would shrink Johnson’s already slim majority to paper thin, and she has said she would sign onto the legislation demanding the release of the files pertaining to the sex trafficking investigation into Jeffrey Epstein, providing the last signature needed to force a vote. Democrats have clamored for the release of the Epstein files, looking to force Republicans to either join their push for disclosure or publicly oppose a cause many in the Republican base support.

Johnson, whose majority is among the most narrow in modern times, has refused to swear Grijalva into office.

The speaker has given shifting reasons for why he won’t allow Grijalva to take her seat, saying he’d do it whenever she wanted but also saying the shutdown needs to end first.

He said it has nothing to do with the Epstein files.

As questions mounted over the House’s next steps, so did the speaker’s exasperation.

“We had the vote. The House has done its job,” he said during Thursday’s press conference.

“The reason the House isn’t here in regular session is because they turned the lights off,” he said. “I’m trying to muster every ounce of Christian charity that I can, but this is outrageous.”

He declined to say if or when the House would be called back to session.

“We’ll keep you posted,” he said. “And let’s pray this ends soon.”

By MELANIE LIDMAN, WAFAA SHURAFA Associated Press

TEL AVIV, Israel (AP) — A ceasefire between Israel and Hamas came into effect in Gaza on Friday, the Israeli military said, hours after Israel’s Cabinet approved a deal to pause the fighting and exchange the remaining hostages for Palestinian prisoners.

Tens of thousands of people who had gathered in Wadi Gaza in central Gaza in the morning started walking north after the military’s announcement at noon local time. Beforehand, Palestinians reported heavy shelling in parts of Gaza throughout Friday morning, but no significant bombardment was reported after.

The ceasefire marks a key step toward ending a ruinous two-year war that has killed tens of thousands of Palestinians, reduced much of Gaza to rubble, destabilized the Middle East, and left dozens of hostages, living and dead, in the territory. Still, the broader plan advanced by U.S. President Donald Trump includes many unanswered questions, such as whether and how Hamas will disarm and who will govern Gaza.

A brief statement from Israeli Prime Minister Benjamin Netanyahu’s office early Friday said the Cabinet approved the “outline” of a deal to release the hostages, without mentioning other aspects of the plan that are more controversial.

Israeli troops have begun to withdraw to agreed-upon deployment lines, the military said. An Israeli security official, speaking on condition of anonymity due to the sensitivity of the withdrawal, said the military would control around 50% of Gaza in their new positions.

In central Gaza’s Nuseirat refugee camp, Mahmoud Sharkawy, one of the many people sheltering there after being displaced from Gaza City, said artillery shelling intensified in the early hours of Friday before the military’s announcement.

“The shelling has significantly increased today,” said Sharkawy, adding that low flying military aircraft had been flying over central Gaza.

Residents of Gaza City in the north also reported shelling in the early hours.

“It is confusing, we have been hearing shelling all night despite the ceasefire news,” said Heba Garoun, who fled her home in eastern Gaza City to another neighborhood after her house was destroyed.

A senior Hamas official and lead negotiator made a speech Thursday laying out what he said were the core elements of the ceasefire deal: Israel releasing around 2,000 Palestinian prisoners, opening the border crossing with Egypt, allowing aid to flow and Israeli forces withdrawing.

Khalil al-Hayya said all women and children held in Israeli jails will also be freed. He did not offer details on the extent of the Israeli withdrawal from Gaza.

A list published Friday by Israel of Palestinian prisoners to be released as part of a the deal does not include high-profile prisoner Marwan Barghouti, the most popular Palestinian leader and a potentially unifying figure. Israel views and some others others as terrorist masterminds who murdered Israeli civilians and has refused to release them in past exchanges.

Al-Hayya said the Trump administration and mediators had given assurances that the war is over, and that Hamas and other Palestinian factions will now focus on achieving self-determination and establishing a Palestinian state.

“We declare today that we have reached an agreement to end the war and the aggression against our people,” Al-Hayya said in a televised speech Thursday evening.

To help support and monitor the ceasefire deal, U.S. officials said they would send about 200 troops to Israel as part of a broader, international team. The officials spoke on condition of anonymity to discuss details not authorized for release.

___

Shurafa reported from Deir al-Balah, Gaza Strip. Sam Mednick in Tel Aviv also contributed

MIAMI (AP) — A storm without a name and unusual king tides were causing some flooding on the Carolina coast early Friday as tropical storms churned in the Atlantic and along Mexico’s Pacific coast.

About a dozen streets were already flooded in Charleston, South Carolina, and the city offered free parking in some garages. A high tide of 8.5 feet (2.6 meters) was forecast Friday morning, which would be the 13th highest in more than a century of recorded data in Charleston Harbor.

The unnamed coastal storm and unusually high king tides, when the moon is closer than usual to the Earth, threatened to bring days of heavy winds that could cause coastal flooding, especially along the vulnerable Outer Banks of North Carolina and around Charleston.

Along the Outer Banks, forecasters said the worst weather should occur Friday through the weekend. They warned it was likely that highway N.C. 12 on Hatteras and Ocracoke islands would likely have to close again because of ocean overwash.

In the Pacific, Tropical Storms Priscilla and Raymond threatened heavy rain along the Mexican coast, and Priscilla could cause flash flooding across the U.S. Southwest through the weekend. Flood watches were issued for parts of Arizona, California and Nevada.

Priscilla was centered about 190 miles (300 kilometers) west-northwest of Cabo San Lazaro, Mexico, and moving north at 6 mph (9 kph) with maximum sustained winds of about 50 mph (85 kph).

A tropical storm warning associated with Raymond was issued from Zihuatanejo to Cabo Corrientes, Mexico. Raymond was forecast to remain off the southwestern coast of Mexico through Friday before nearing Baja California Sur on Saturday and Sunday.

Raymond was about 95 miles (150 kilometers) south-southeast of Zihuatanejo, Mexico. It had maximum sustained winds of 50 mph (80 kph) and was moving west-northwest at 15 mph (24 kph), forecasters said.

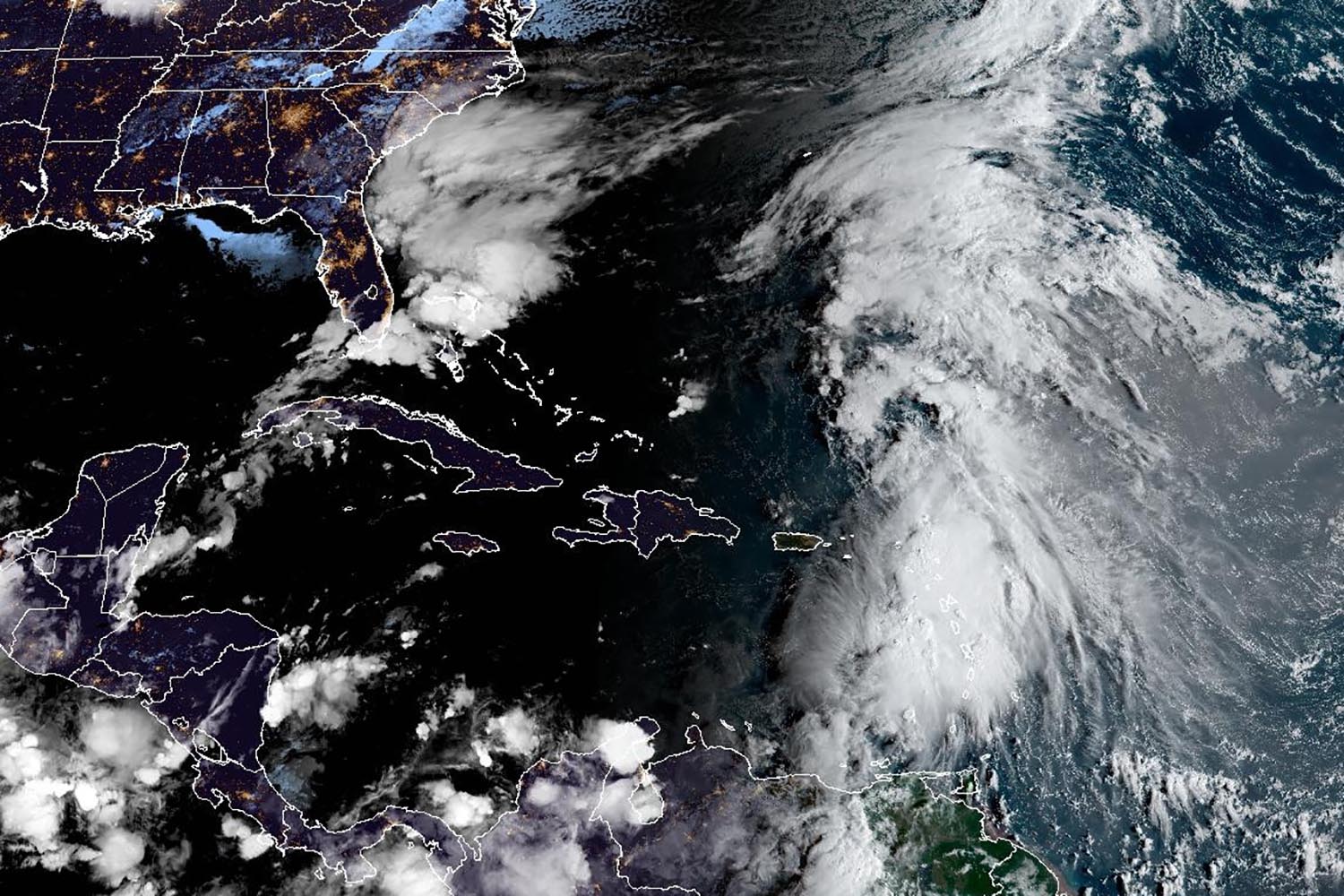

In the Atlantic, Jerry was passing east of the northern Leeward Islands and causing heavy rainfall. Officials in Guadeloupe warned of potential power outages.

Jerry was centered about 65 miles (100 kilometers) east-northeast of the northern Leeward Islands and moving northwest at 16 mph (26 kph) with maximum sustained winds of 60 mph (95 kph).

A tropical storm warning was in effect for Barbuda and Anguilla, St. Barthelemy and St. Martin, Sint Maarten and Guadeloupe and the adjacent islands. A tropical storm watch was in effect for Antigua, St. Kitts, Nevis and Montserrat and Saba and St. Eustatius, the hurricane center said.

The storm should strengthen into a hurricane Saturday. The Nor’easter expected to send rain and pounding waves into the Southeast U.S. is helping steer Jerry away from the islands and into the open Atlantic, forecasters said.

Also Thursday, Subtropical Storm Karen formed far from land in the north Atlantic Ocean. Karen had maximum sustained winds of 45 mph (75 kph) and was expected to maintain that strength through the day.

A subtropical storm tends to have a wide zone of strong winds farther from its center compared to a tropical storm, which generates heavier rains, according to the U.S. National Weather Service.

About seven weeks remain in the 2025 Atlantic hurricane season, and meteorologists warned the Pacific Ocean cooling pattern called La Nina, which can warp weather worldwide and turbocharge hurricanes, has returned.

It may be too late in the hurricane season to impact tropical weather in the Atlantic, but this La Nina may have other impacts from heavy rains to drought across the globe.

This recipe is a quick way to have an amazing lunch! You can customize your wrap with your favorite veggies, protein and spreads and even meal prep wraps for later in the week.

1. Prep the veggies

Chop up the veggies you plan to use in your wrap.

2. Toast the tortilla

On low heat, slightly toast the tortilla on the stove for 1-2 minutes on each side.

3. Assemble the wrap

Spread the hummus and avocado evenly on the tortilla and sprinkle with salt and pepper, then add the veggies and (optional) protein of your choice. Then, fold in the sides of the tortilla and roll upwards to create the wrap.

4. Enjoy

Enjoy the wrap immediately or pack it to enjoy later! The crunch of the veggies and smoothness of the spreads makes for a tasty lunch.

The longer the string, the higher the kite will fly. Play the long game.

By LARRY NEUMEISTER and ANDREW DALTON Associated Press

NEW YORK (AP) — A federal judge tossed out a defamation lawsuit that Drake brought against Universal Music Group on Thursday, ruling that lyrics branding the superstar as a pedophile in Kendrick Lamar’s dis track “Not Like Us” were opinion.

Judge Jeannette A. Vargas rejected the suit in a written opinion that began by citing “the vitriolic war of words” and saying the case arose “from perhaps the most infamous rap battle in the genre’s history.”

The case stemmed from an epic feud between two of hip-hop’s biggest stars over one of 2024 biggest songs, which won record of the year and song of the year at the Grammys, got the most Apple Music streams worldwide and helped make this year’s Super Bowl halftime show the most watched ever.

Vargas said a reasonable listener could not have concluded that “Not Like Us” was conveying objective facts about Drake.

“Although the accusation that Plaintiff is a pedophile is certainly a serious one, the broader context of a heated rap battle, with incendiary language and offensive accusations hurled by both participants, would not incline the reasonable listener to believe that “Not Like Us” imparts verifiable facts about Plaintiff,” Vargas wrote.

Filed in January, the lawsuit alleged that UMG published and promoted the track even though it included false pedophilia allegations against Drake and suggested listeners should resort to vigilante justice.

The lawsuit also alleged that the track tarnished his reputation and decreased the value of his brand.

Universal Music Group, the parent record label for both artists, denied the allegations.

“From the outset, this suit was an affront to all artists and their creative expression and never should have seen the light of day,” UMG said in a statement. “We’re pleased with the court’s dismissal and look forward to continuing our work successfully promoting Drake’s music and investing in his career.”

Lamar was not named in the lawsuit.

There was no immediate response to mails sent to representatives for Drake seeking comment.

“Not Like Us” was released as the two artists were trading a flurry of insult tracks. Lamar’s song called out the Canadian-born Drake by name and impugned his authenticity, attacking him as “a colonizer” of rap culture who’s “not like us” in Lamar’s home turf of Compton, California, and, more broadly, West Coast rap.

“Not Like Us” also makes insinuations about Drake’s sex life, including, “I hear you like ’em young” — implications that he rejects.

In his lawsuit Drake asserted that the song amounts to “falsely accusing him of being a sex offender, engaging in pedophilic acts” and more.

He also blamed the tune for attempted break-ins and the shooting of a security guard at his Toronto home. The mansion was depicted in an aerial photo in the song’s cover art.

In June the judge heard oral arguments on the request to toss out the lawsuit.

Dalton reported from Los Angeles. Associated Press writer Jennifer Peltz contributed.

HIGH POINT, N.C. (AP) — A North Carolina state House member has been charged with sex-related crimes involving a teenager earlier this year, court records show.

Six-term Democratic state Rep. Cecil Brockman, 41, of High Point, was arrested Wednesday on two counts each of statutory sexual offense with a child and taking indecent liberties with a child, according to a magistrate’s order detailing his arrest.

The magistrate’s order says Brockman is twice accused in or around Aug. 15 of engaging in a sexual act with a 15-year-old and is twice alleged to have committed and attempted to commit “a lewd and lascivious act” upon the juvenile. The alleged victim in each felony count was identified by the same initials. The State Bureau of Investigation is involved in the caase.

Brockman was being held without bond, according to the Guilford County Sheriff’s Office. His scheduled Thursday afternoon court appearance was postponed until Friday — as a message in the state’s electronic court records system said that Brockman was in the hospital on Wednesday. More details weren’t immediately provided there.

Sheriff’s Office spokesperson Bria Evans said Thursday she had no information on Brockman’s medical status, citing privacy law, but said that he was still in custody of the High Point jail run by the office.

An assistant for Brockman at his legislative office said Brockman didn’t have a comment Thursday. A voice message left on a phone number connected to Brockman wasn’t immediately returned. The online court records provided no information on whether he had an attorney.

In separate statements, the North Carolina Democratic Party, Republican House Speaker Destin Hall and House Democratic leader Rep. Robert Reives all called on Brockman to resign immediately his General Assembly seat. So did Democratic Gov. Josh Stein.

“These charges are extremely serious and deeply troubling,” Stein said in a written statement. “While the legal process has yet to play out, it’s clear he cannot effectively serve his constituents and should resign immediately.”

The minimum prison sentence for someone convicted of the statutory sexual offense count is at least 12 years, according to state sentencing directives, while taking indecent liberties with a child can be punishable by active prison time, probation, or both.

A document signed by a Guilford County magistrate explaining in part why Brockman’s release wasn’t authorized on Wednesday said the defendant “is a state representative and has access to abundant resources to aid in his flight from prosecution.”

In addition, the document said, Brockman has “made attempts to contact the victim in this case,” even trying to locate the young person in the hospital and “to use his status” to gain information about the teenager’s whereabouts.

Brockman, who was first elected to the legislature in 2014, has been targeted politically by fellow Democrats in recent years for his willingness to vote with Republicans on some key bills. In July, he and a couple other House Democrats helped the GOP override successfully some of Democratic Gov. Josh Stein’s vetoes.

A past supporter of some school choice initiatives, Brockman is one of four vice chairs on the House K-12 education committee during this General Assembly term, joining three Republicans. Brockman narrowly survived a primary challenge in the 2024 election for the 60th House District seat that represents southwest Guilford County, including High Point.

By AARON BEARD AP Sports Writer

Of all the ugly moments so far — bad play, blowout losses, home fans fleeing early for the exits — the most telling moment of Bill Belichick’s first season at North Carolina came during an open week.

It took the form of a pair of terse statements from Belichick and athletic director Bubba Cunningham posted on social media late Wednesday, reaffirming the marriage between the six-time Super Bowl winner from the NFL’s New England Patriots and the school desperately seeking to elevate its football program beyond decades of also-ran status.

“I’m fully committed to UNC Football and the program we’re building here,” Belichick said.

The fact it came at all, though — following a day of speculation and reports of behind-the-scenes troubles in the program — said more about how the first few weeks of Belichick’s first college season have gone.

The messaging about building the “33rd” NFL team with a pro-style approach at a college program has given way to school leaders and the Tar Heels’ general manager pleading for patience from fans and donors jarred by the team’s lack of competitiveness. And now the school is looking into potential NCAA rules violations involving an assistant coach.

It all comes amid elevated financial investments into the program, none more significant than spending at least $10 million annually to hire the 73-year-old Belichick as a first-time college coach.

“It’s not the kind of thing we judge after four games or even after one season,” Chancellor Lee Roberts told reporters after a meeting of university trustees two weeks ago. “These things take time.”

The Tar Heels (2-3) have managed a total of four touchdowns in three losses to power-conference opponents, each coming by at least 25 points. One of their two wins came against a Championship Subdivision opponent in Richmond.

In games against fellow Bowl Subdivision opponents, UNC ranks last among all 67 power-conference teams in scoring offense (13.3), total offense (253.0) and third-down conversion rate (26.5%). They also rank amid the bottom dozen in scoring defense (30.8), total defense (416.8) and third-down conversion defense (43.4%), according to SportRadar.

UNC opened Belichick’s tenure on Labor Day with a national TV spotlight, only to see TCU roll to a 48-14 win that had UNC fans largely gone from Kenan Stadium by the end of the third quarter.

Last week, it happened again, this time by halftime, as Clemson took a 28-3 lead in the first quarter in a game that ended in a largely empty Kenan Stadium.

“We’re just going to keep working every day and every week,” Belichick said afterward. “And let the guys get better. And the guys that get better will keep playing. And the guys that don’t, maybe there’s other people that can compete and move ahead of them for playing time. But we’re just going to keep grinding. I’m not going to evaluate where things are or aren’t. Just take it week by week.”

The Tar Heels next visit California on Oct. 17 in their first cross-country league trip since the Atlantic Coast Conference’s expansion last year.

The school is also dealing with issues away from the games themselves.

A person with knowledge of the situation said cornerbacks coach Armond Hawkins has been suspended while the school looks into potential violations tied to improper benefits for players. A timetable for that suspension is unclear. The person spoke to The Associated Press on condition of anonymity Thursday because UNC hasn’t publicly discussed the suspension, first reported by The Athletic.

Additionally, a planned TV show from streaming provider Hulu on Belichick’s first UNC team is no longer in development, the person told the AP. The program had posted social media video in August of Belichick telling the players that the Tar Heels would be featured in what he described as a season-long show to “showcase” the program.

General manager Michael Lombardi, a former NFL executive, recently sent a letter to donors encouraging them to remain patient. He outlined a plan that included signing “upwards of 40” high school players in next year’s class to restock the program, indicating the need for a longer-term building effort.

“First and foremost, this letter isn’t an excuse or to shed blame on the past regimes,” Lombardi wrote in the letter, first reported by Football Scoop and later reviewed by the AP. “It’s meant to explain our team building blueprint moving forward, now that we have surveyed the inherited land.”

Changing course would be expensive, too.

Belichick is in the first year of a deal that guarantees $10 million in base and supplemental pay for each of the next seasons. Lombardi is making $1.5 million for each of the next two seasons. And most of the staff — which includes Belichick’s sons Steve and Brian, as well as Lombardi’s son Matt — holds two-year deals.

It would cost more than $30 million to buy out those staff contracts if UNC opted to make a coaching change.